SCS

0.0200

A US investment firm has proposed to stop a controversial oil auction in DR Congo's rainforests, bidding to exploit carbon credits instead of drilling in the environmentally sensitive areas.

In July, the Democratic Republic of Congo opened bidding for 27 oil blocks, arguing that exploiting its fossil resources was an economic imperative for the impoverished central African country.

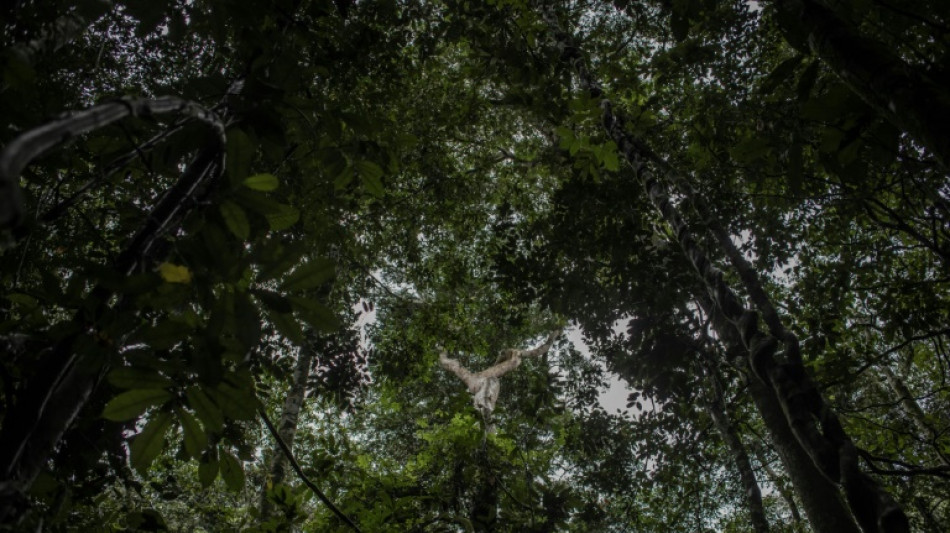

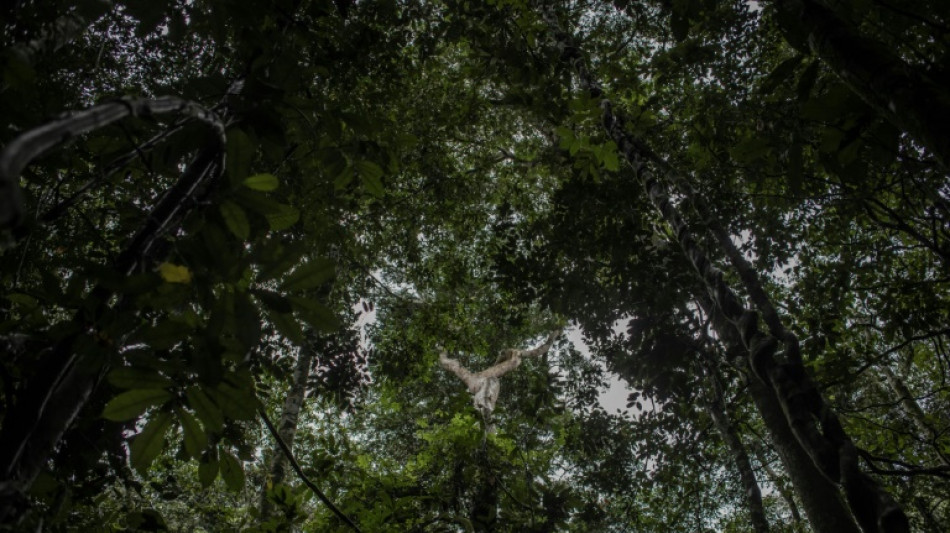

But some of the blocks overlap with protected areas in the basin of the Congo River -- a huge carbon sink and rainforest haven second in size only to the Amazon.

Green groups have warned of dire consequences should the oil industry move in.

The danger is considered particularly acute in the central Congo Basin peatlands, which researchers estimate store around 30 billion tonnes of carbon.

Worldwide carbon dioxide (CO2) emissions for 2021 stood at about 37 billion tonnes, according to Global Carbon Project, a monitor.

Investment firm EQX Biome has filed a bid for the 27 oil blocks, setting out an alternative business case to extraction, designed to protect the forest.

The New York-based company is proposing to spend $400m in conservation projects, which would then generate $6 billion over 20 years through the sale of carbon credits, according to CEO Matthias Pitkowitz.

Planting trees or protecting tropical rainforests have become popular tools for companies to offset CO2 emissions or burnish their green credentials.

Companies can buy carbon credits, from certified conservation projects, that represent the volume of CO2 prevented from being emitted into the atmosphere. One credit typically represents one tonne of C02.

A condition of EQX Biome's bid is that the government call off oil drilling in all 27 blocks.

Pitkowitz argues that the proposal makes better economic sense than oil, with the potential to create thousands of local jobs and generate taxable revenue.

"$6 billion instead of oil drilling," he told AFP. "This isn't dreamland".

The $6bn-revenue figure is based on estimates about the success of the conservation projects, which would then would generate carbon credits, Pitkowitz explained.

He declined to comment on whether EQX Biome, founded in 2022, had secured funding for its proposed $400m investment.

The DRC's hydrocarbons ministry did not respond to questions.

- Contested credits -

Proponents argue that carbon credits are a viable mechanism to avoid deforestation.

But critics warn that forests do not store carbon permanently -- trees release carbon back into the atmosphere when they die -- and that some companies may use credits to cover for increased emissions.

A recent scandal over the alleged ineffectiveness of projects certified by leading carbon-credit provider Verra has also cast a shadow over the industry.

A lax regulatory environment in the DRC, one of the world's poorest and most corrupt countries, has also triggered skepticism about efforts to use carbon credits to protect its vast tracts of remote forest.

“Their plan is very ambitious,” said a Western diplomat following environmental issues in the DRC, explaining that EQX Biome had little direct experience in the country, or in the carbon-credits market.

But the diplomat said that it was important to explore credits as a tool to fight deforestation despite criticisms of the relatively new mechanism.

It is unclear which other firms have submitted bids for the 27 oil blocks.

Companies have until October to submit bids on some of the blocks, according to the hydrocarbons ministry.

In the DRC's Cuvette Centrale region -- one of the most sensitive areas comprising forests and peatlands -- bidding ends in July and August.

Hydrocarbons Minister Didier Budimbu has previously indicated that he is open to bids to carbon-credit groups.

Thomas Annicq, CEO of carbon-credits firm Oneshot.earth, said that his company expressed an interest bidding but the Congolese government never responded to a request for further information.

"I felt like they didn't take it seriously," he said, adding that carbon credits have more to offer longterm than fossil fuels.

The value of the voluntary carbon market -- where firms can purchase carbon credits from conservation projects -- reached about $2 billion in 2021, according to Boston Consulting Group. It is expected to rise to $10-40 billion by 2030.

H.Nadeem--DT