SCS

0.0200

Rising food costs pushed consumer inflation in China last month to its fastest pace in nearly two years, data showed Wednesday, but lower factory-gate prices suggested demand in the world's second-largest economy remains weak.

Chinese policymakers have been battling sluggish spending for years, with a prolonged debt crisis in the property sector and lingering effects from the Covid pandemic weighing on consumer sentiment.

Experts have long argued Beijing needs to shift towards a growth model based more on domestic consumption and less on exports and manufacturing -- though that has proven easier said than done.

The consumer price index (CPI), a key measure of inflation, jumped 0.7 percent year-on-year in November, according to the National Bureau of Statistics (NBS).

The reading was in line with a Bloomberg forecast and much higher than October's 0.2 percent increase.

It also rose at the fastest pace since posting the same figure in February 2024. The CPI has not exceeded that since February 2023.

"The expansion... was mainly driven by a shift from declines to increases in food prices," NBS statistician Dong Lijuan said in a statement.

Fresh vegetable prices in particular surged due to weather shifts, Dong noted, reversing nine straight months of decline.

Zichun Huang of Capital Economics acknowledged the "weather-related rise" but added that the data also showed "a decline in services inflation and household appliance prices".

Authorities expanded a subsidy scheme earlier this year in a bid to spur flagging consumer activity.

But results have been mixed, with a short-term burst in purchases failing to halt a longstanding slump in sentiment.

The latest figures reflected "the fading impact of the consumer goods trade-in scheme on retail sales", Huang said in a note.

- 'Patriotic to spend money' -

China's leaders are targeting overall growth this year of around five percent -- the same as last year, and a goal that many economists initially considered ambitious.

But in a promising sign for Beijing, the International Monetary Fund (IMF) said Wednesday it had revised its annual growth forecast for China to five percent, up from 4.8 percent in October.

The IMF also hiked its growth prediction for next year to 4.5 percent from 4.2 percent.

"Despite sizeable shocks, China's economy has shown remarkable resilience," IMF chief Kristalina Georgieva told journalists in Beijing after annual discussions with senior Chinese officials.

Authorities have taken positive steps to boost domestic spending, she said, though she cautioned that "more is needed".

Georgieva took aim at thrifty older Chinese, whom she called "very committed to savings".

Younger people need to help them "change their attitude towards one that says it's patriotic to spend money", she said.

- Weak demand persists -

China's official economic data also highlighted persistent woes.

The producer price index (PPI) -- which measures the cost of goods before they enter wholesale or distribution -- fell by 2.2 percent last month, NBS data showed. The Bloomberg survey had forecast two percent.

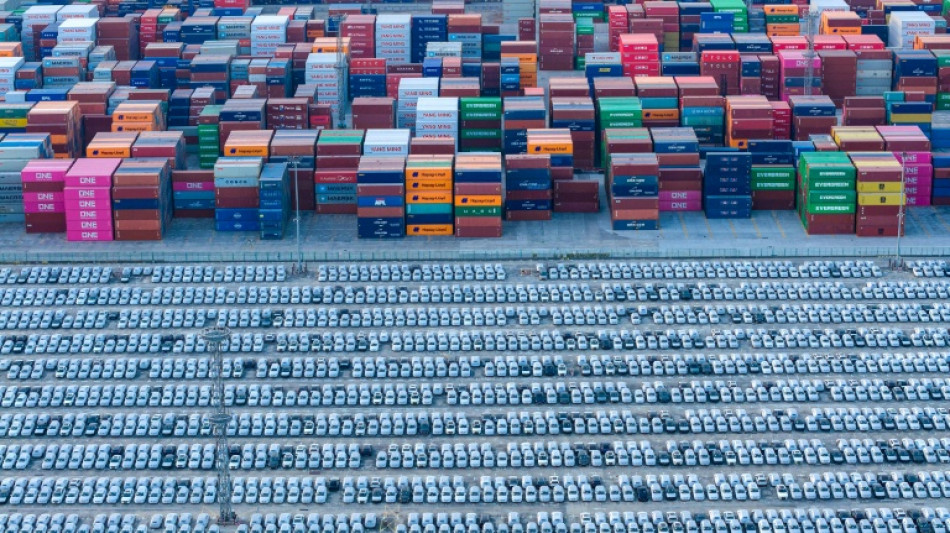

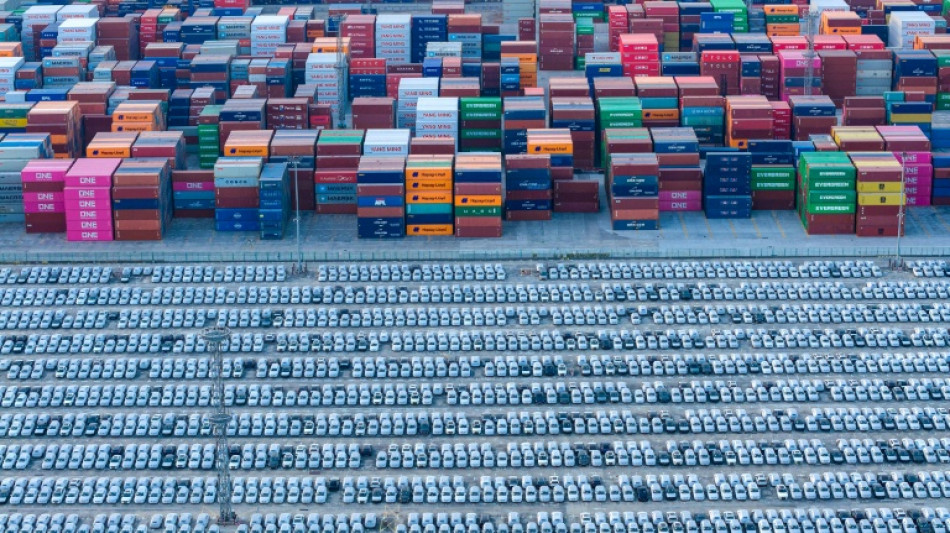

The monthly PPI has been in negative territory for more than three years, reflecting weak demand and a global oversupply of Chinese manufactured goods.

"We expect overcapacity to remain in place, keeping China in deflation next year and in 2027," Huang, of Capital Economics, said.

China's exports have boomed in recent years, providing a key economic lifeline for Beijing despite heightened trade tensions with the United States and other Western governments.

Data on Monday showed China's towering trade surplus this year surpassed $1 trillion for the first time.

French President Emmanuel Macron warned over the weekend that Europe would "be forced to take strong measures" -- including tariffs -- if Beijing fails to reduce its massive surplus with the continent.

Y.Sharma--DT