SCS

0.0200

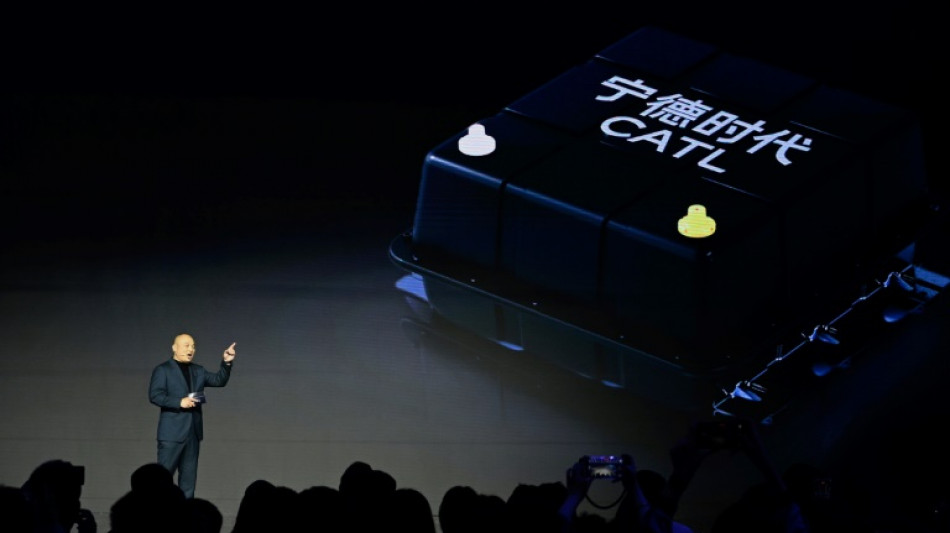

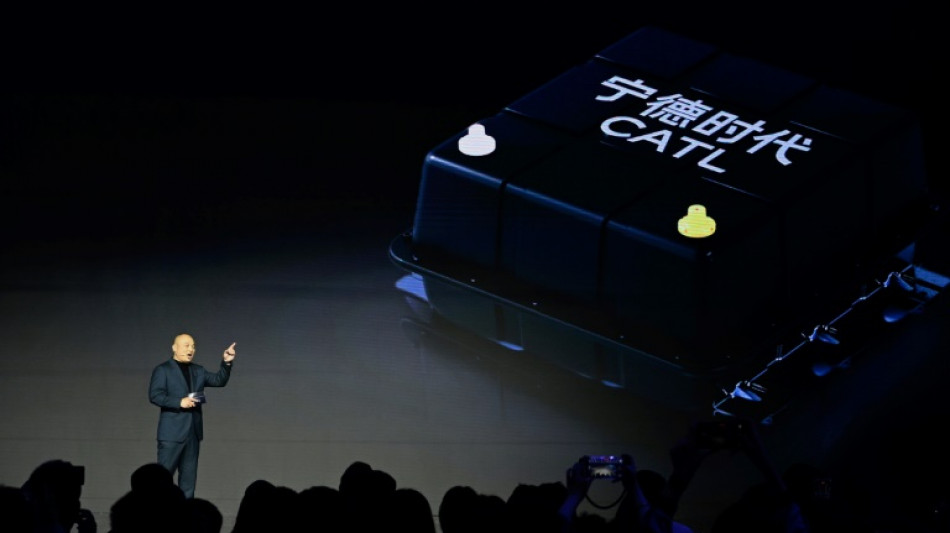

Chinese EV battery giant CATL aims to raise $4 billion in its Hong Kong listing scheduled for May 20, said a statement filed to the bourse Monday, making it the largest IPO expected in the city so far this year.

A global leader in the sector, CATL produces more than a third of all electric vehicle (EV) batteries sold worldwide, working with major brands including Tesla, Mercedes-Benz, BMW and Volkswagen.

The company is already listed in Shenzhen, and its plan for a secondary listing in Hong Kong was announced in a December filing with the stock exchange.

According to a prospectus filed Monday, CATL will offer approximately 117.9 million units priced at up to HK$263 per share ($33.8) for total expected proceeds of HK$31.01 billion.

The listing is set to take place next Tuesday (May 20).

Cornerstone investors, including Sinopec and Kuwait Investment Authority, agreed to buy shares worth HK$2.62 billion, the prospectus shows.

Founded in 2011 in the eastern Chinese city of Ningde, Contemporary Amperex Technology Co., Limited (CATL) was initially propelled to success by rapid growth in the domestic market.

But the world's largest EV market has more recently begun to show signs of flagging sales amid a broader slowdown in consumption.

The trends have fuelled a fierce price war in China's expansive EV sector, putting smaller firms under huge pressure to compete while remaining financially viable.

But CATL continues to post solid performances, with its net profit jumping 32.9 percent in the first quarter.

Funds raised from a secondary listing could be used to accelerate CATL's overseas expansion, particularly in Europe.

The battery giant is building its second factory on the continent in Hungary after launching its first in Germany in January 2023.

In December, CATL announced that it would work with automotive giant Stellantis on a $4.3 billion factory to make EV batteries in Spain, with production slated to begin by the end of 2026.

- 'Military-linked company' -

Earlier analysts said CATL's float could be a blockbuster initial public offering that could boost Hong Kong's fortunes as a listing hub.

Hong Kong's stock exchange is eager for the return of big-name Chinese listings in hopes of regaining its crown as the world's top IPO venue.

The Chinese finance hub saw a steady decline in new offerings since Beijing's regulatory crackdown starting in 2020 led some Chinese mega-companies to put their plans on hold.

In a list issued in January by the US Defense Department, CATL was designated as a "Chinese military company".

The United States House Select Committee on the Chinese Communist Party highlighted this inclusion in letters to two American banks in April, urging them to withdraw from the IPO deal with the "Chinese military-linked company".

But the two American banks -- JPMorgan and Bank of America -- are still on the deal.

Beijing has denounced the list as "suppression", while CATL denied engaging "in any military related activities".

According to Bloomberg, CATL plans to make the deal as a "Reg S" offering, which doesn't allow sales to US onshore investors, limiting the company's exposure to legal risks in the United States.

B.Krishnan--DT