CMSC

0.0050

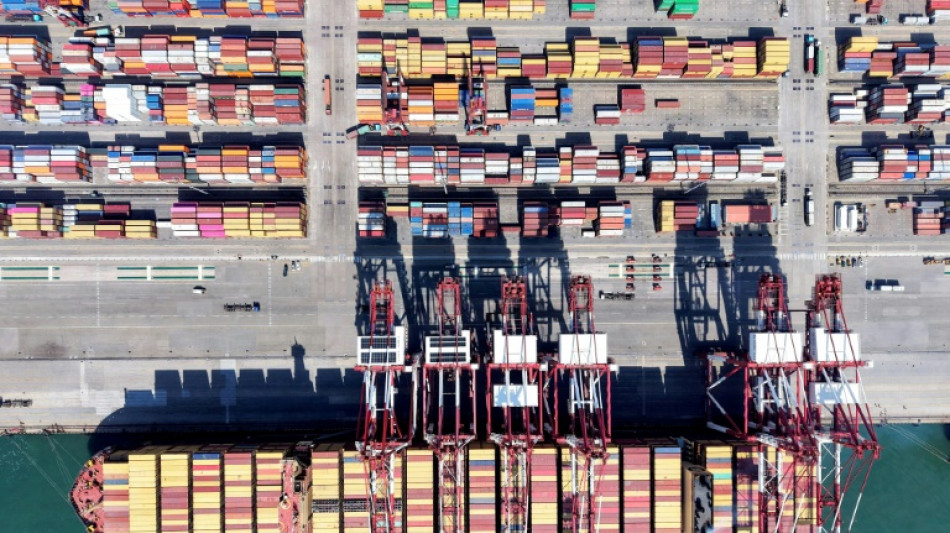

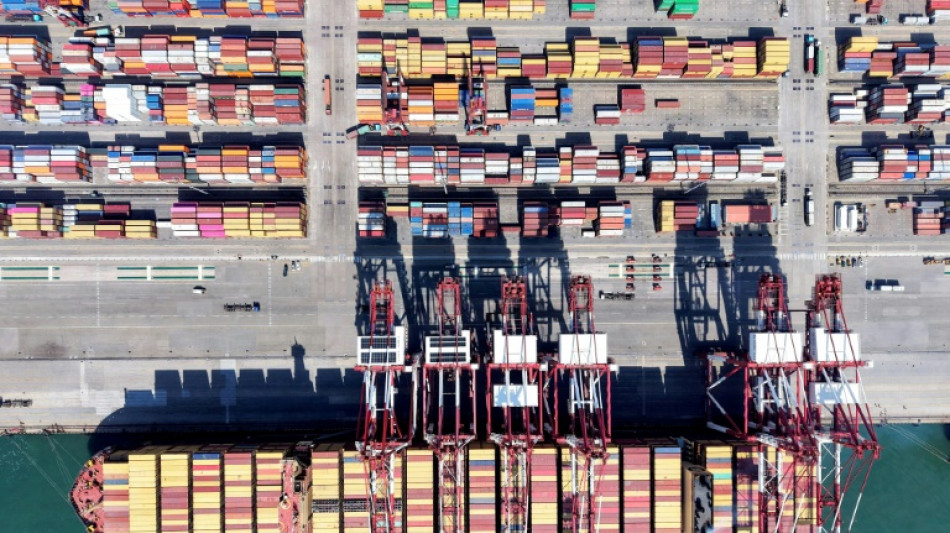

China on Wednesday said its economy grew a forecast-beating 5.4 percent in the first quarter as exporters rushed to get goods out of factory gates ahead of swingeing new US tariffs.

Beijing and Washington are locked in a fast-moving, high-stakes game of brinkmanship since US President Donald Trump launched a global tariff assault that has particularly targeted Chinese imports.

Tit-for-tat exchanges have seen US levies imposed on China rise to 145 percent, and Beijing setting a retaliatory 125 percent toll on US imports.

Official data Wednesday offered a first glimpse into how those trade war fears are affecting the Asian giant's fragile recovery, which was already feeling the pressure of persistently low consumption and a property market debt crisis.

Beijing's National Bureau of Statistics (NBS) said that "according to preliminary estimates, the gross domestic product in the first quarter... (was) up by 5.4 percent year on year at constant prices".

That was above the 5.1 percent predicted by analysts polled by AFP ahead of the data release.

Retail sales, a key gauge of consumer demand, climbed 4.6 percent year-on-year, the NBS said, while industrial output soared 6.5 percent in the first quarter of the year, up from 5.7 percent in the final three months of 2024.

But Beijing warned the global economic environment was becoming more "complex and severe" and that more was needed to boost growth and consumption.

"The foundation for sustained economic recovery and growth is yet to be consolidated," the NBS said, adding there was a need for "more proactive and effective macro policies".

Figures released Monday showed Beijing's exports soared more than 12 percent on-year in March, smashing expectations, with analysts attributing it to a "frontloading" of orders ahead of Trump's so-called "Liberation Day" tariffs on April 2.

Trump said this week that the "ball is in China's court" when it comes to drawing down those eye-watering tariffs.

China's economy, the world's second-largest, was already struggling to rebound from a pandemic-induced slowdown, with the double-digit growth that fuelled its rise now a distant memory.

Beijing in 2024 announced a string of aggressive measures to reignite the economy, including interest rate cuts, cancelling restrictions on homebuying, hiking the debt ceiling for local governments and bolstering support for financial markets.

But after a blistering market rally last year fuelled by hopes for a long-awaited "bazooka stimulus", optimism waned as authorities refrained from providing a specific figure for the bailout or fleshing out any of the pledges.

China's top leaders last month set an ambitious annual growth target of around five percent, vowing to make domestic demand its main economic driver.

Many economists consider that goal to be ambitious given the problems facing the economy.

A.Ragab--DT